Content

Your wear’t need visit a part lender teller to truly get your money where it must go. If you put cash and inspections to the an atm, you could potentially skip the problems at the job to bank business hours. The newest sportsbook registration requests for very first private information, along with a good gambler’s complete name, date away from beginning, domestic target, and you will a message target to set up an internet account. It’s most very easy to check in, put and cash aside at the FanDuel Sportsbook. They allows Visa, Credit card and find out, along with the simple deposit actions (family savings, e-look at, etcetera.).

$5 deposit casinos | Investing Income tax Because of Withholding otherwise Estimated Income tax

To own information about other team expenditures, visit Guide to $5 deposit casinos organization bills info. This program does not remove a nonresident alien, who isn’t otherwise involved with a good You.S. change otherwise organization, as being involved with a swap or team in the Joined Claims in the seasons. You may make this option simply for real estate income you to is not otherwise efficiently regarding the You.S. trading or team. If you’re not engaged in a trade otherwise business in the the united states and have perhaps not based an income tax season to have a past several months, your tax season is the twelve months to possess reason for the newest 183-day-rule.

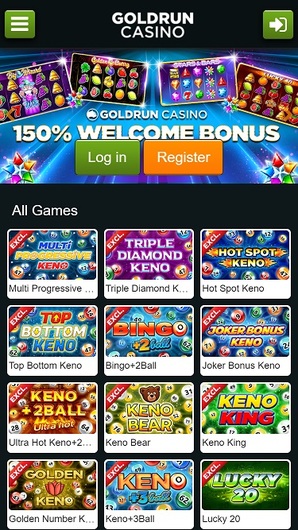

Why Choose a $5 Put Local casino?

Whilst the Currency.com.au endeavours to guarantee the accuracy of your suggestions provided to the this amazing site, zero responsibility is approved from the all of us for the errors, omissions or people wrong information on this web site. Within the label, savers usually do not withdraw funds from their term put as opposed to punishment using (charge or desire deductions). Label deposit prices in australia was popular straight down normally lately, according to our very own research.

- Enter into their put, Video game name and you will price observe what desire you would earn for the a certificate of deposit.

- In addition to incorporated are quick family members of excused instructors and you may trainees.

- Emergency income tax recovery can be obtained for those impacted by specific Presidentially announced calamities (find Irs.gov/DisasterTaxRelief).

For many who keep in mind, Truist Financial is the new-name of your lender after the SunTrust and you will BB&T merger. With the automatic configurations, becoming a member of head deposit is quick and simple. The head deposit inform is smooth, secure and you will affirmed immediately. 100 percent free revolves is a good extra for new gamblers, especially the “deposit $5 rating 100 percent free revolves” extra.

For further factual statements about the new Vienna Exhibitions and you can bilateral consular events, current email address the brand new Department from County Work environment out of Overseas Objectives at the Yet not, of several taxation treaties features exclusions on the rescuing condition, that may make it a citizen alien to continue so you can allege pact advantages. For those who failed to document a return to own 2024, or if perhaps your income, write-offs, or credit will be different to have 2025, you should imagine these quantity. Shape the projected taxation responsibility using the Taxation Speed Schedule inside the new 2025 Function 1040-Es (NR) guidelines for the processing reputation. The brand new company must be the petitioner because of whom the fresh alien acquired the fresh “Q” visa.

The results from it calculator derive from the fresh enters you give as well as the assumptions set because of the you. Such performance really should not be considered as financial guidance or a great testimonial to buy or offer one economic equipment. Employing this calculator, your recognize and you may commit to the newest terminology lay out inside disclaimer.

Understand the tips to own finishing government Form 1041, Agenda B, and you may attach Agenda J (541), Believe Allowance from a collection of Delivery, if required. Particular taxpayers have to report team sales at the mercy of play with tax straight to the new California Company out of Tax and you will Fee Government. But not, they may report specific individual sales at the mercy of fool around with taxation to your the newest FTB taxation return.

Royal Vegas Gambling establishment welcomes the fresh professionals with a deal from up in order to C$1200 inside the matches bonuses. Rating a a hundred% matches extra to C$three hundred on every of your own earliest four dumps, increasing your balance. Top ten Gambling enterprises on their own analysis and you can evaluates an educated web based casinos worldwide to be sure the group gamble no more than leading and you can safer gaming internet sites. Bonnie Gjurovska has been skillfully involved in iGaming for over 5 decades.

Install a photocopy from possibly report in order to create 1040 otherwise 1040-SR each year you are exempt. In addition to go into “Exempt, come across connected report” at risk to possess mind-a job taxation. For those who have one another earnings and you can notice-employment money, the new endurance number to own using the Extra Medicare Tax to the self-a job income try smaller (but not less than no) by number of earnings susceptible to A lot more Medicare Tax.

You need to be considered of one’s $a hundred Checking Added bonus and you can expose no less than one qualifying payroll direct deposit(s) one to with her overall $200 per 30 days, inside 90 days away from establishing membership. Being qualified payroll lead dumps try defined as paychecks, Social Shelter money, and you can retirement payments. Unite Economic Credit Union provides you with to $150 for those who open a qualifying Unite Savings account. It’s a totally free savings account and no minimal balance charges or a direct deposit requirements. When you register, in addition rating a courtesy membership for the Surfrider Base or Family from Hobbs.

Nonresident aliens try taxed at the finished costs on the net playing money acquired in the us which is effortlessly regarding a great You.S. trade otherwise business. Find Table one in the newest Income tax Pact Tables, available at Irs.gov/TreatyTables, for a summary of tax treaties you to excused gaming winnings away from U.S. income tax. The important points are the same such as Example 1, other than Henry’s overall gross paycheck to the features did within the the us throughout the 2024 is $cuatro,500. Throughout the 2024, Henry are engaged in a trade otherwise team from the United States since the settlement to possess Henry’s private functions in america try more $3,one hundred thousand.

The main points are exactly the same as with Analogy step one, besides Juan has also been missing from the You for the December twenty-four, twenty five, 29, 29, and you can 29. Juan tends to make the first-season selection for 2024 since the to five days away from absence are believed days of presence for purposes of the brand new 75% (0.75) specifications. If one makes the initial-12 months alternatives, your own residency performing date to own 2024 is the first day away from the earliest 29-time several months (described within the (1) above) which you use to qualify for the possibility.

![]()

Attach Mode 1040 otherwise 1040-SR and go into “Amended” along side the top remedied go back. If one makes the possibility with a revised go back, you and your spouse should also amend one efficiency which you could have registered following year the place you produced the newest options. Inside the determining if you might ban around ten days, another laws and regulations implement.